For Overseas Motorhome Investors claiming back your tax is easy.

If you live in the UK and decide to take advantage of the Motorhome Investment scheme you are responsible for your own tax which means that if you put £36,000 into the scheme, you will be paid £225 each and every month during your 3 year investment term. The situation is slightly different if you live permanently overseas. In this case 20% tax is deducted from the £225 each month and you are paid £180 per month and £45 is paid as tax to HMRC. Don’t worry though, because each April you can claim this money back very easily. This is done using an HMRC R43 form which you can download and print out from here. The form is just 4 pages long, but there are only a few parts to fill in.

One of our overseas motorhome investors is David who moved to the Provence-Alpes-Côte d’Azur region of France in 2002. David works as entertainer and has a french Autoentrepreneur tax status, which means he is responsible for paying his own tax for what he earns. David invested £36,000 in the motorhome invest scheme in October 2013. David wrote to us with some scans of the forms, with his personal details obscured for obvious reasons. The process is not difficult, but he thought it would help other overseas investors and ‘would be’ investors feel more confident about getting their tax back. Here is David’s explanation of how he claimed back his first lot of tax from his motorhome investment in April 2014:

After I passed the age of 50 I was able to take out my company pension early. I spent a long time with a calculator working out if it was better to wait until I was 60 to take out my pension or if I should take it now and invest it in the motorhome investment scheme. To most people this would sound like insanity, but the pay back of 7.5% on the motorhome investment scheme is so good that there really wasn’t a lot in it. It also meant that when I go back to the UK to visit my family and friends I have free motorhome hire whilst I am there. Perfect! I was a little worried at the time about how easy it would be to get the tax back, but in reality it was very simple indeed. Here is the whole process:

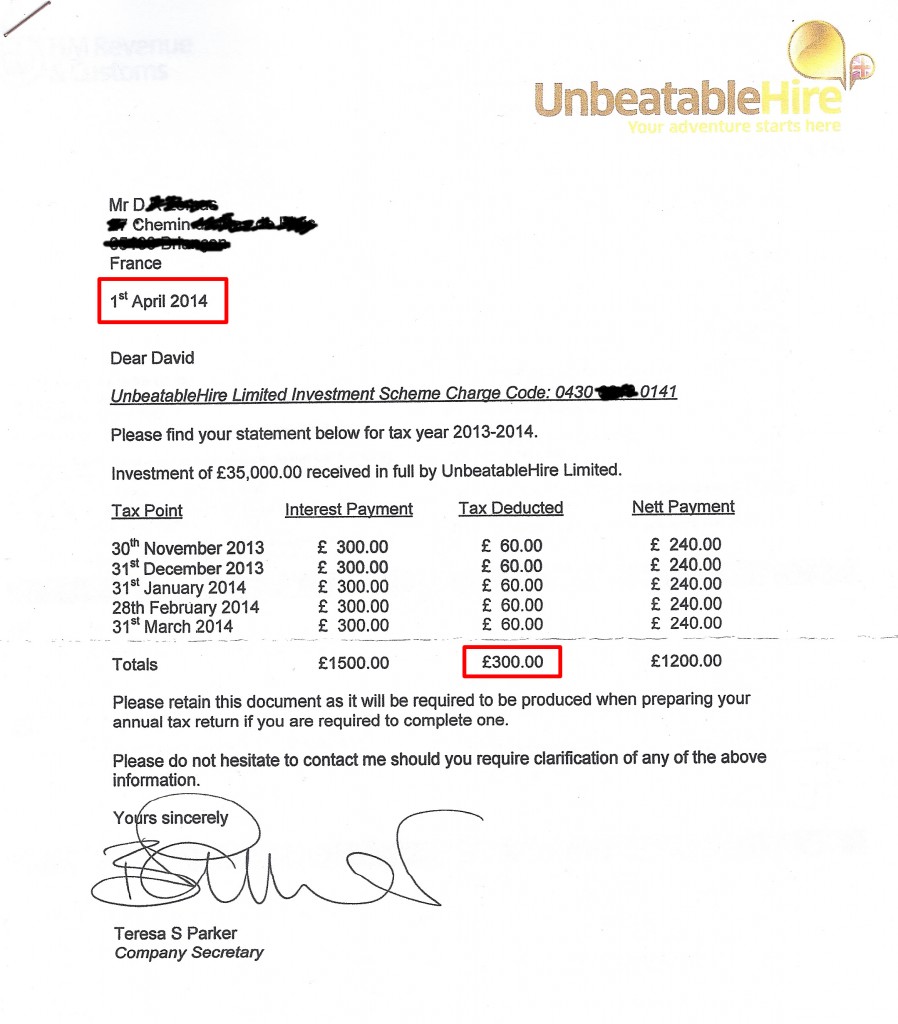

1. Wait until you receive your statement from the motorhome company

Tax Statement for Motorhome Investment

You can see here that as this was my first year of my motorhome investment I had only received 5 payments in the 2013-2014 tax year. So instead of receiving £1500, I had received £1200 and paid £300 in tax. This was the £300 I needed to claim back. In subsequent years this will be a full 12 months which will be £720, quite a nice sum of money to receive each Spring! This letter was sent to me on April 1st 2014.

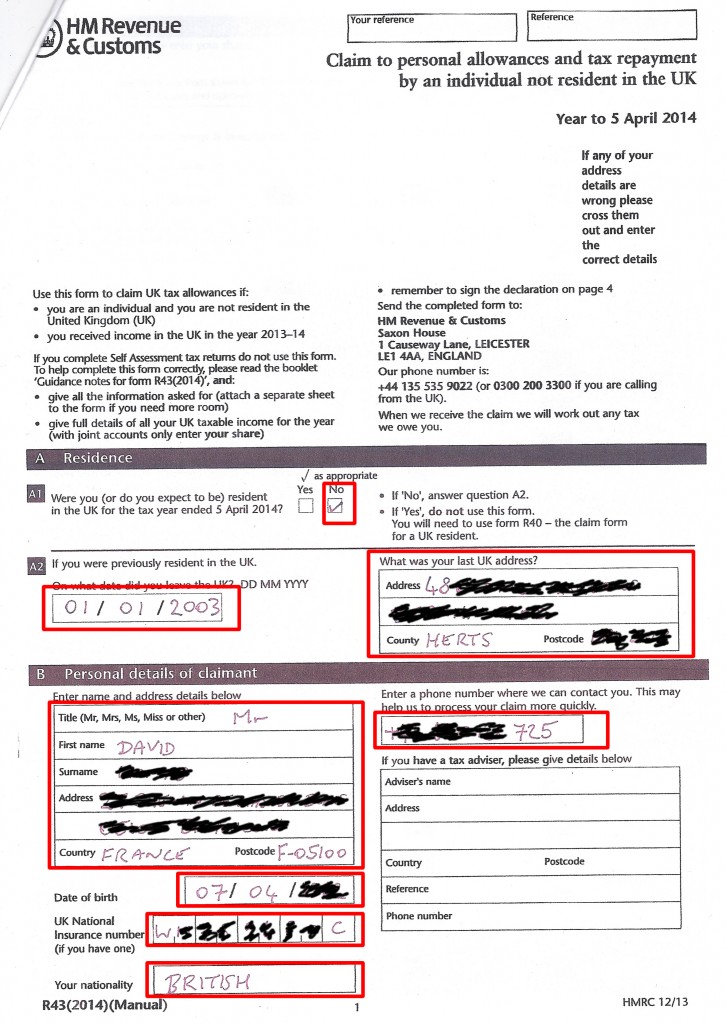

2 Download and complete the HMRC R43 Tax Form

As with most goverment forms you can download the ‘notes for the R43 form’ too, but you don’t really need to, it’s quite simple.

R43 Page 1

On the first page these are the details you need to add;

- I ticked the box to say that I would not be resident in the UK on April 5th 2014.

- I added the date I left the UK and also,

- my last UK address

- my current address (this is where they send the cheque)

- my phone number (I used my french mobile prefixed with the +33, but nobody called)

- Date of Birth

- National Insurance Number

- Nationality

HMRC Tax Form R43 P1

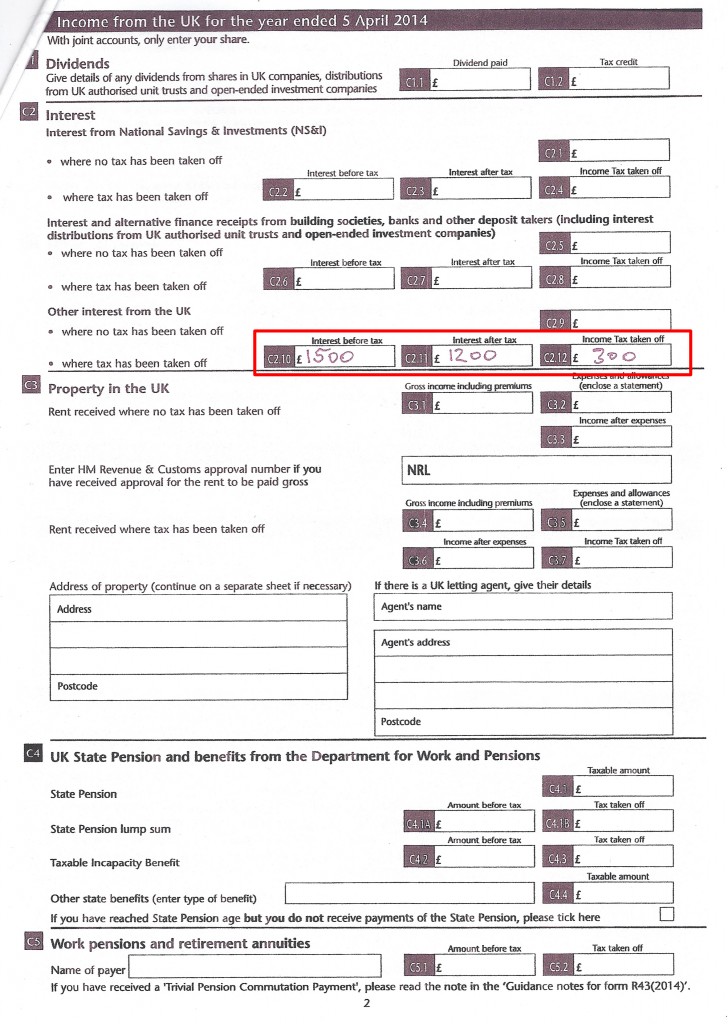

R43 Page 2

All you need to add on page 2 is some details in the ‘Other interest from the UK’ section. You just need to fill in:

- the interest before tax

- the interest after tax

- Income tax taken off

HMRC Tax Form R43 P2

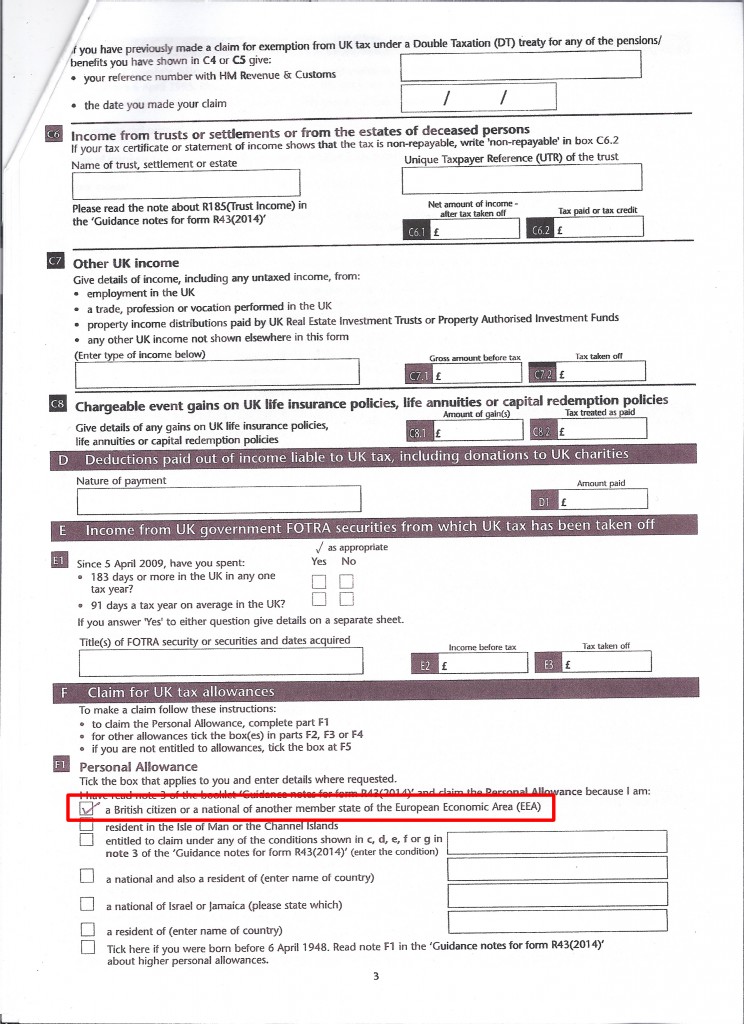

R43 Page 3

On page 3 I just ticked the box to say that I was a British citizen or a national of another member state of the European Economic Area (EEA). To be honest I am not totally sure which one of those I am, but I am definitely one of them! I have a British Passport, so I guess I am probably still a British Citizen.

HMRC Tax Form R43 P3

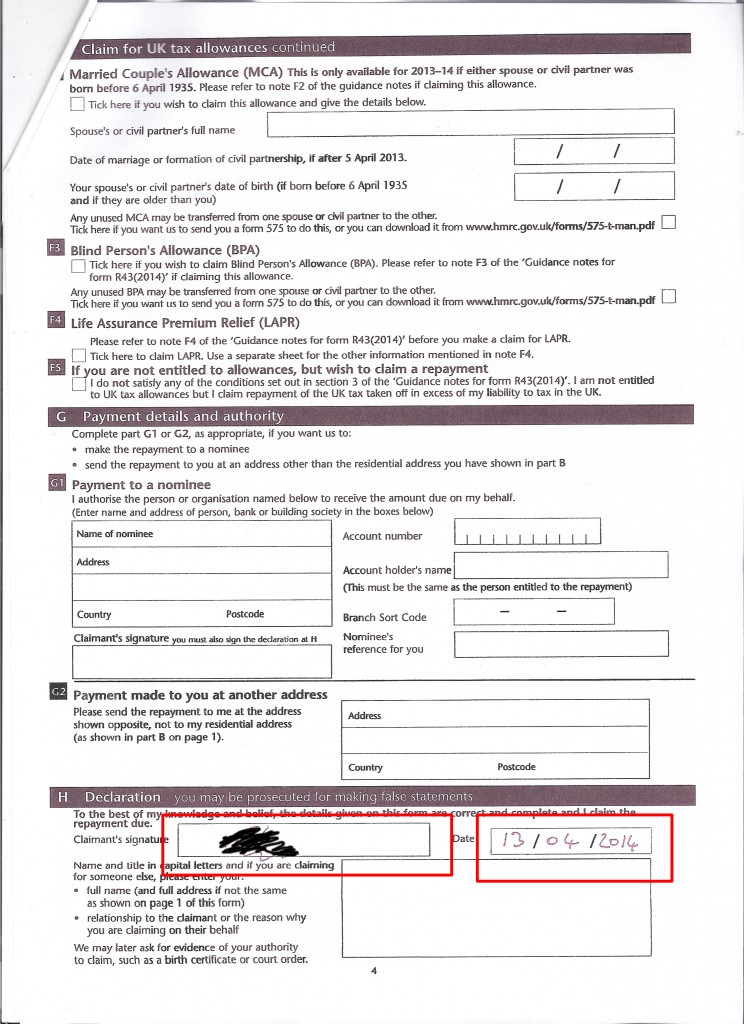

R43 Page 4

On page 4 I just signed and dated the form and that was it.

HMRC Tax Form R43 P4

The form needs to be sent to:

HMRCPAYE & Self Assesment

BX9 1AS

ENGLAND

It’s probably worth going to your local post office and getting them to weigh the letter as some countries have quite low weight limits for overseas mail. I also enclosed a copy of the tax statement from the motorhome company.

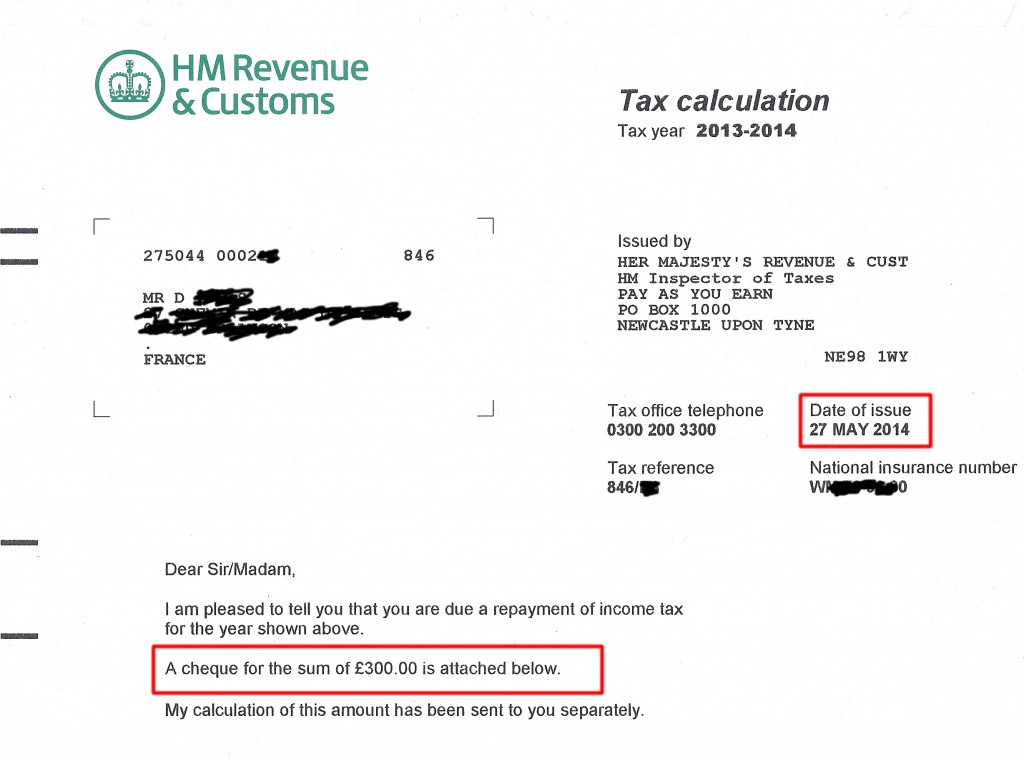

Now wait for your cheque to arrive

I sent the R43 off on April 15th 2014 and on May 27th I recieved the Tax Calculation from HM Revenue & Customs with a cheque for £300 attached. Boom!

HMRC R43 Tax Calculation

If you have £36,000 to invest I would seriously consider going along to one of the Motorhome Investment Open Days, it really is a very straightforward and lucrative investment. I now honestly believe that it is now a better investment than buying property.